|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Low Cost Chapter 13 Bankruptcy Options

Filing for bankruptcy can be a daunting process, especially when trying to manage costs. Chapter 13 bankruptcy offers a viable option for many, but it's crucial to understand how to file without breaking the bank.

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy, often referred to as a wage earner's plan, allows individuals with regular income to create a plan to repay all or part of their debts. It enables debtors to keep their property and pay debts over time, usually three to five years.

Advantages of Chapter 13

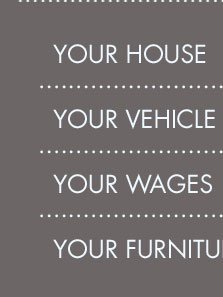

- Asset Retention: Unlike Chapter 7, you can keep your assets while repaying debts.

- Debt Consolidation: Payments are consolidated into a single monthly payment.

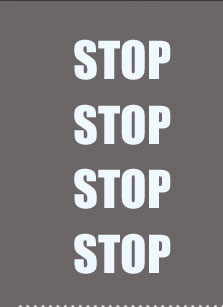

- Legal Protection: Stops foreclosures and repossessions.

Finding Low Cost Options

There are various ways to file for Chapter 13 bankruptcy affordably. Research and compare costs of different attorneys or consider alternative resources.

Choosing the Right Attorney

When searching for a salt lake bankruptcy attorney, consider their experience, client reviews, and cost structure. Many offer free initial consultations to discuss your case.

Utilizing Free Resources

Many non-profit organizations provide free or low-cost legal advice and workshops on bankruptcy proceedings. These can be invaluable in understanding your options without incurring high costs.

Filing Process and Considerations

Understanding the filing process can help minimize costs. Preparing the necessary documents and knowing what to expect can streamline the process.

Required Documentation

- List of creditors and amounts owed

- Source of income and frequency

- List of property and monthly living expenses

Being organized can reduce the time an attorney spends on your case, potentially lowering fees.

FAQs

Can I file Chapter 13 without an attorney?

Yes, you can file without an attorney, a process known as 'pro se.' However, it's not recommended due to the complexity of bankruptcy laws. Consulting a professional can save time and ensure proper handling of your case.

How can I reduce my bankruptcy filing costs?

Shop around for attorneys who offer competitive rates or payment plans. Additionally, look for free legal aid services in your area. For example, you can explore north carolina bankruptcy filings for local assistance programs.

What happens if I can't afford the Chapter 13 payment plan?

If you can't afford your payment plan, you might be able to modify the plan or convert to Chapter 7 bankruptcy, provided you meet the eligibility requirements. It's crucial to discuss this with your attorney promptly.

By understanding the intricacies of Chapter 13 bankruptcy and exploring low-cost options, you can navigate financial distress with greater ease and confidence.

According to the most recent update of the schedule, published in 2020, petitioners can expect to pay a $78 filing fee they file for Chapter 13 bankruptcy.

Click here to view the list of Low Bono (low cost) Chapter 13 attorneys. Home. United States Bankruptcy Court - DISTRICT of MARYLAND ...

The fee can be divided into up-front fees and fees deferred and included in the Chapter 13 plan. This is where attorneys can be flexible and take less up-front ...

![]()